Why Retirement Transition Coaching?

Retirement Vital Signs

August 25, 2021For most of us, our work defines us. Work provides an income, arranges our schedules, provides us with an identity, and much–if not most–of our social connections. The transition from work to retirement is a significant change. The prevailing advice we receive, from the first professional job onwards, is to make a financial plan for retirement. However, few have been encouraged to develop a plan for the non-financial realities of retirement. We seem to believe that if we have the financial means to retire, the rest will take care of itself. Financial security alone will not guarantee a successful or fulfilling retirement.

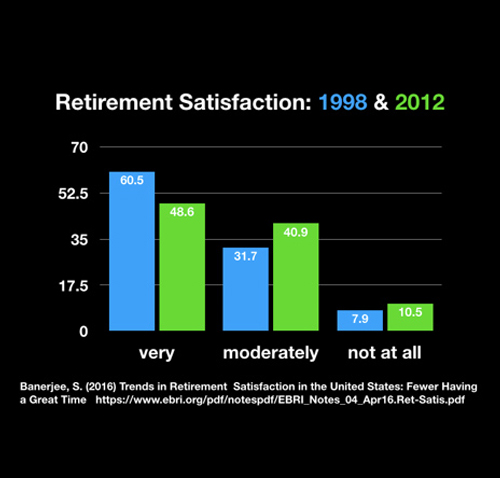

Retirement is less satisfying than it was in the past

The most recent data available suggests that retirement is less satisfying for people than it was in the past. In a study comparing retirement satisfaction in 1998 and 2012, fewer retirees were very satisfied and more retirees were not at all satisfied. While the shifts in satisfaction are not vast, the trend is disturbing. It is difficult to discover why this shift has taken place, yet it is noteworthy that it is happening. It is also worth recognizing that you can plan for and modify aspects of your life that are most likely to impact your retirement satisfaction.

Who is most at risk of a problematic retirement transition?

Despite a lack of formalized non-financial planning, the retirement transition is reasonably smooth for some, and for others, it can be quite tricky. There are a number of risk factors for having a difficult retirement transition.

- No (or poor) non-financial retirement plan. The less one has thought about and worked out a plan and to manage the changes to family, friendships, time and activities that inevitably take place with retirement, the more difficult the transition.

- Unwanted retirement. Down-sized, laid-off or golden parachuted – whatever the term used to describe the exit – the less wanted the exit from employment was, the more difficult the transition to retirement is likely to be.

- Heavily identified with work role. Some people define who they are by their work. This identity can lead to a profoundly meaningful and fulfilling work life. However, transitioning to a new role can be especially difficult for some people.

- Multiple transitions at one time. Experiencing a divorce, death of a spouse, significant change in your medical condition, or are selling a business, a person may be at higher risk for a difficult retirement transition. The more transitions a person faces at one time will compound the difficulty in adjusting to retirement.

- Few non-work relationships or community relationships. If most of a persons social contact came through work, the social transition may be a very challenging one.

- Exaggerated view of the role of leisure in retirement. Perhaps your retirement plan is to go fishing, or to play golf every day. While these kinds of activities can be very rewarding, if not balanced by non-leisure activities, ongoing fulfillment may wane.

- Other on-going stresses. If caring for aging parents, supporting struggling adult children or serving as primary care taker of grandchildren – there may be some initial relief when no longer working full time, however, these stresses can also negatively impact your transition.

Even if you do not recognize yourself in the above categories, you may recognize a need to be more intentional in thinking about and planning for your post “work” life. From whom do you seek advice and consultation?

How can a Retirement Transition Coach help?

Would you plan to build a house without consulting an architect? Do you do your taxes, or hire a CPA to assist you with this complex task? If you noticed a sharp recurring pain in your knee, would you visit a physician? None of us can be an expert in everything we encounter – so it is helpful to consult specialists who have helped others with similar problems. Even though we may read a book on home design, tax policy or joint problems – the expert consultant provides a level of assessment, knowledge and support that self-help does not provide. What specifically does retirement transition coaching provide?

- Education about the retirement transition process. There are predictable patterns and problems that are encountered in retirement. Understanding the various adaptations you will need to make can help you get a big picture of retirement transition.

- A customized transition plan. The way you manage retirement will be different than the way others do. Your unique needs and preferences are taken into account in building a plan that will work for you and has the flexibility to address new challenges you may face in the future.

- Objective support. While many friends and family may offer advice and support, they sometimes have their own agendas, and may not have the experience or skill in assisting your transition.

- Ongoing assistance, if needed. Developing a customized, individual plan requires a flexible approach.The initial planning period usually takes about 3 or 4 meetings spaced over a month or six weeks. The exact amount of coaching depends on the unique situation. Sometimes a new development or difficulty arises that warrants additional consultations.